People are buying fewer of these.

An analysis of price increases on sugar-sweetened beverages in five US cities revealed a significant impact: a 31% price hike led to a one-third reduction in consumer purchases of these drinks. Scott Kaplan, an assistant professor of economics at the US Naval Academy, highlighted the study’s focus on how consumers altered their buying patterns in response to price shifts.

“For every 1% price rise, we noticed a corresponding 1% drop in the purchase of these products,” Kaplan stated. “This decline was immediate post-tax implementation and remained consistent over the subsequent three years of our investigation.”

However, William Dermody from the American Beverage Association, representing the beverage industry, criticized such taxes, labeling them as unproductive and detrimental to consumers, small businesses, and employees. He emphasized the industry’s efforts to offer more choices with reduced sugar, smaller portions, and clear calorie information, contributing to a decline in beverage calories consumed.

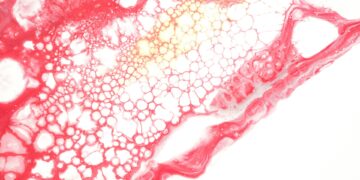

Despite these assertions, numerous studies have linked sugar-sweetened beverages to chronic diseases such as heart disease, cancer, diabetes, obesity, and stroke. Even modest consumption of these drinks has been associated with heightened cardiovascular disease risk. Both sugary and artificially sweetened beverages have been connected to increased mortality risk from various causes.

Kaplan acknowledged that their study didn’t directly evaluate the health impact of reduced sugary drink sales. However, a prior Tufts University study suggested that a 15% to 20% decline in sugary beverage consumption nationwide could potentially decrease healthcare costs significantly.

Parke Wilde, a Tufts researcher, shared the belief that a 33% drop in consumer purchases might yield similar cost reductions in healthcare. He emphasized that reduced beverage sales likely contributed to curbing obesity, heart disease, and fatalities in the five cities examined.

The study’s significance lay in its refined assessment of price effects, with Wilde suggesting that had this study been available earlier, it would have been a primary reference for their research due to its comprehensive evaluation of price impacts.

Kaplan noted that while nine US jurisdictions and over 50 countries have implemented taxes on sugar-sweetened beverages, the method varies. Some places tax distributors, who then pass the cost to consumers, while others levy sales taxes directly on these drinks, affecting pricing differently.

For instance, Kaplan explained that an ounce-based tax substantially raises the overall cost compared to a sales tax. He exemplified how a 2-cent-per-ounce tax could add 24 cents to a $1 12-ounce soda, contrasting significantly with an 8% sales tax in Washington, DC, resulting in a marginal 2-cent increase for the same can.

Ultimately, Kaplan highlighted the potential for ounce-based taxes to drive more significant impacts on consumer behavior due to their higher cost implications compared to sales taxes.

Discussion about this post